|

The

Calcutta Stock Exchange Association

Limited 7 , Lyons Range Calcutta - 700 001 Phone:

2210-4470-7, , 2220-1488, 2220-6977, 2220-3335, 2220-6928,

Cable : CALSTOCK Fax : 033-22202514,2210-4486, 2210-4500, |

23rd

June 2004

Notice

Sub: Mandatory Use of STP system for all Institutional trades

executed on the Stock Exchanges

SEBI vide circular No. DNPD/Cir-22/04 dated April 01, 2004 (Annexure A) has, inter-alia, advised that all institutional trades executed on the stock exchanges would be mandatorily processed through the Straight Through Processing (STP) System w.e.f. July 01, 2004. As referred in the aforesaid circular in continuation thereof , SEBI issued the following circulars in this regard.

SEBI circular no. & date |

Subject |

Annexure |

DNPD/Cir-23/04 dated April 27,2004 |

Detail System Flow of STP System |

Annexure B |

DNPD/CIR-24/04 dated May 26, 2004 |

SEBI (STP centralised hub and STP service providers) Guidelines, 2004, prescribing the model agreement between the STP centralised hub and STP service providers. |

Annexure C |

DNPD/Cir-25/04 dated June 10, 2004 |

Transaction work flow for the system of Straight Trough Processing in the Indian Securities Market and standarisation of the messaging format. |

Annexure D |

The copies of all the aforesaid SEBI circulars, the contents of which are self-explanatory, are annexed for the information of the members. The above circulars are also available in the websites of the Exchange and SEBI i.e., cse-india.com and sebi.gov.in respectively.

Members are requested to take note of the aforesaid circulars and note that the STP system shall be initially mandatory for all institutional trades in the equity segment w. e. f. July 1, 2004 and all market participants shall issue the Electronic Contract Notes for institutional trades in the modified format as per the aforesaid SEBI Circulars.

Secretary

Annexure- A

PRATIP

KAR

EXECUTIVE

DIRECTOR

DNPD/Cir- 22 /04

April 01, 2004

To

All Stock Exchanges, Depositories and Custodians.

Dear Sir,

Mandatory

use of STP system for all institutional trades executed on the stock exchanges.

Straight Through Processing (STP) is generally understood to be a mechanism that automates the end to end processing of transactions of financial instruments. It involves use of a system to process or control all elements of the work flow of a financial transaction, what are commonly known as the Front, Middle, Back office and General Ledger. In other words, STP allows electronic capturing and processing of transactions in one pass from the point of order origination to final settlement. STP thus streamlines the process of trade execution and settlement and avoids manual entry and re-entry of the details of the same trade by different market intermediaries and participants. Usage of STP enables orders to be processed, confirmed, settled in a shorter time period and in a more cost effective manner with fewer errors. Apart from compressing the clearing and settlement time, STP also provides a flexible, cost effective infrastructure, which enables e-business expansion through online processing and access to enterprise data.

SEBI vide letter dated October 3, 2002 informed the stock exchanges, depositories and custodians that it proposed to introduce STP for electronic trade processing with a common messaging standard ISO 15022 w.e.f December 2, 2002. Accordingly, STP was launched in India on November 30, 2002. Currently, STP is being used by the market participants on a voluntary basis. To facilitate STP, SEBI has also issued circulars SMDRP/POLICY/Cir-15/00 dated December 15, 2000 & circular SEBI/SMD/SE/15/2003/29/04 dated April 29, 2003 which permitted the issue of electronic contract notes with digital signature obtained from a valid Certifying Authority provided under the Information Technology Act, 2000 (IT Act) and circular no. DNPD/Cir-9/04 dated February 3, 2004 & circular no. SEBI/MRD/SE/Cir-11/2004 dated February 25, 2004 directing exchanges to amend their bye-laws, rules and regulations for the equity and the debt segment to streamline the issuance of electronic contract notes as a legal document like the physical contract note. Exchanges are in the process of amending their bye-laws, rules and regulations.

While several STP Service Providers have been providing STP service to the market participants, however, there was no inter-operability between the STP Service Providers.

To resolve the issue of inter-operability between the STP Service Providers, it has been decided in consultation with the stock exchanges and the STP Service Providers that a STP Centralised Hub would be setup. Currently this STP Centralised Hub has been setup and made operational by NSE. NSE has obtained the necessary approvals from Department of Telecommunications (DoT) as an Internet Service Provider (ISP). Subsequently this STP Centralised Hub would be further developed jointly with BSE.

In view of the aforesaid developments, it has been decided that all the institutional trades executed on the stock exchanges would be mandatorily processed through the STP System w.e.f July 01, 2004. This circular is being issued to provide adequate notice to the market and market participants about the mandatory use of STP Service for institutional trades. A circular containing the detailed process flow, role and responsibilities of the STP Service Providers and the STP Centralised Hub, standard agreement between the STP Service Providers and the STP Centralised Hub would be issued shortly.

This circular is being issued in exercise of powers conferred by section 11 (1) of the Securities and Exchange Board of India Act, 1992, read with section 10 of the Securities Contracts(regulation) Act 1956, to protect the interests of investors in securities and to promote the development of, and to regulate the securities market.

Yours faithfully,

PRATIP KAR

Annexure B

GENERAL MANAGER

DNPD/Cir-23/04

April 27, 2004

All Exchanges, Clearing Corporation / Clearing House,

Depositories, Custodians, AMFI, STP service providers and STP Centralized Hub

Dear Sir,

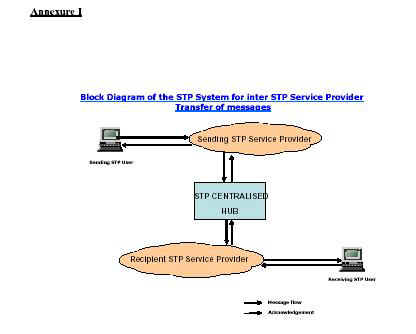

b) The STP service provider would verify the signature of the STP user and forward it to the

i) recipient STP user, if the recipient

STP user is availing services of the same STP service provider; or the

ii) STP centralized hub if the recipient STP user is not with the same STP service

provider. In such a case the STP service provider would be required to prepare a message

as per the STP centralized hub prescribed message format, enclose the user’s message,

digitally sign the message and then send it to the STP centralized hub

c) On receipt of the message by the STP

centralized hub, the STP centralized hub would

i) verify the signature of the sending STP service provider only.

ii) send an acknowledgment to the sending STP service provider.

d) The STP centralized hub would forward the message to the recipient STP service provider after digitally signing on the message.

e) The recipient STP service provider on receipt of the message from the STP centralized hub, shall verify the signature of the STP centralized hub, verify if the recipient STP user is associated with itself and send an appropriate acknowledgment with digital signature to the STP centralized hub. The STP centralized hub would in turn forward the acknowledgment (received from the recipient STP service provider) duly signed to the sending STP service provider.

f) The recipient STP service provider shall forward the message to the recipient STP user. The recipient STP user would receive the message and verify the signature of the recipient STP service provider and sending STP user.

3) To enable inter-operation, the STP centralized hub would provide a utility / client software to the STP service provider. The STP service provider’s point of interface with the STP centralized hub would be through this utility / client software. The PKI (Public key infrastructure) system for the interface shall be implemented at a later stage.

Yours faithfully,

D. RAVIKUMAR

Annexure C

CHIEF GENERAL

MANAGER

DERIVATIVES AND

NEW PRODUCTS DEPARTMENT

DNPD/Cir-24/04

May 26, 2004

All Exchanges,

Clearing Corporation / Clearing House,

Depositories,

Custodians, AMFI, STP service providers and STP Centralized Hub

Sub: Straight

Through Processing Service in the Indian Securities Market

Dear Sir,

1)This is in continuation to our previous circular no. DNPD/Cir-9/04 dated February 3, 2004 & circular no. SEBI/MRD/SE/Cir-11/2004 dated February 25, 2004 streamlining the issuance of electronic contract notes as a legal document like the physical contract note for the equity and debt segments, circular no. DNPD/Cir-22/2004 dated April 1, 2004 mandating the use of the Straight Through Processing (STP) system for all institutional trades w. e. f. July 1, 2004 and circular no. DNPD/Cir-23/ 04 dated April 27, 2004 prescribing the detailed system flow of the STP system.

2) SEBI in

order to regulate the STP service is hereby issuing the SEBI (STP centralised hub and STP

service providers) Guidelines, 2004 (herein referred to as “STP Guidelines”)

which also prescribes the model agreement between the STP centralised hub and the STP

service providers.

4) To prescribe

contractual obligations between the STP centralised hub and the STP service providers and

to facilitate standardisation of service, a model agreement between the STP centralised

hub and the STP service providers has also been prescribed by SEBI and is prescribed as

Schedule II of the STP Guidelines. The agreement between the STP centralised hub and the

STP service provider shall include the provisions included in the model agreement.

5) This circular is being issued in exercise of powers conferred by section 11 (1) of the Securities and Exchange Board of India Act, 1992, read with section 10 of the Securities Contracts(regulation) Act 1956, to protect the interests of investors in securities and to promote the development of, and to regulate the securities market.

Annexure D

CHIEF GENERAL MANAGER

DERIVATIVES AND NEW PRODUCTS

DEPARTMENT

DNPD/Cir-25/04

June 10, 2004

All Exchanges, Clearing Corporation / Clearing House, STP Centralised Hub

Depositories, Custodians, AMFI and STP service providers

Sub: Transaction work flow for the system of

Straight Through Processing in the Indian Securities Market and standardisation of the

messaging formats

Dear Sir,

1. This is in continuation to our previous circular no. DNPD/Cir-9/04 dated February 3, 2004 & circular no. SEBI/MRD/SE/Cir-11/2004 dated February 25, 2004 on the issuance of electronic contract notes as a legal document like the physical contract note for the equity and debt segments, circular no. DNPD/Cir-22/2004 dated April 1, 2004 mandating the use of the Straight Through Processing (STP) system for all institutional trades w. e. f. July 1, 2004, circular no. DNPD/Cir-23/04 dated April 27, 2004 prescribing the detailed system flow of the STP system and circular no. DNPD/Cir-24/04 dated May 26, 2004 prescribing the SEBI (STP centralised hub and STP service providers) Guidelines, 2004.

2. SEBI in consultation with the STP centralised hub, STP service providers and the STP users has prescribed the transaction work flow for the STP system. All institutional investors shall follow the following transaction work flow on a mandatory basis from July 1, 2004:

a. A contract note in electronic form in the prescribed format (IFN 515 messaging format) shall be issued by the broker & sent to the custodian and / or the institutional investor.

b. In case the contract note is processed directly by the institutional investor, the institutional investor shall send the trade confirmation of acceptance or rejection of the contract note to the broker by using the IFN 598 messaging format. The custodian shall also send the confirmation of acceptance or rejection of such contract note to the broker using the messaging standard IFN 548.

c. In case the contract note is processed by the custodian on behalf of the institutional investor, the custodian shall send the confirmation of acceptance or rejection of the contract note to the broker by using the IFN 548 messaging format.

d. The institutional investor shall send settlement instructions to its custodian in IFN 540 to IFN 543 messaging formats to the custodian for the following trade types:

- IFN 540: settlement instruction for a clearing house buy trade

- IFN 541: settlement instruction for a delivery-v/s-payment (DVP) buy trade

- IFN 542: settlement instruction for a clearing house sell trade

- IFN 543: settlement instruction for a delivery-v/s-payment (DVP) sell trade

e. The custodian shall confirm / reject the execution of the settlement instructions to the institutional investor in IFN 544 to IFN 547 messaging formats in the following manner:

- IFN 544: confirmation / rejection of an instruction received in messaging format IFN 540

- IFN 545: confirmation / rejection of an instruction received in messaging format IFN 541

- IFN 546: confirmation / rejection of an instruction received in messaging format IFN 542

- IFN 547: confirmation / rejection of an instruction received in messaging format IFN 543

f. It is clarified that if a message (for the activities mentioned above) is sent using the STP centralised hub framework from one user to another user, then the confirmation / rejection for such a message shall also be sent using the STP centralised hub framework.

3. SEBI vide circular no. DNPD/Cir-9/04 dated February 3, 2004 had prescribed the format of the contract note in electronic form. After deliberation with the STP service providers and the market participants the following changes are incorporated to the existing messaging format (IFN 515):

- The mandatory requirement of mentioning the relevant bye-laws / rules / regulations of the exchange subject to which the said contract note is being issued on each contract note stands modified in the following manner:

- The requirement is not mandatory but optional

- The broker shall ensure that the relevant bye-laws / rules / regulations of the exchange subject to which the contract note is being issued, is mentioned in the broker-client agreement and the tripartite agreement between the broker-sub-broker-client agreement (if applicable).

- The existing field for the above provision shall not be deleted and may be used as a free text field for one constituent to communicate remarks (if any) to another constituent.

- The clause of ‘payment of consolidated stamp duty’ for each contract note shall be mentioned in the broker-client agreement and the tripartite agreement between the broker-sub-broker-client agreement (if applicable). The said clause may be stated in the free text field (as mentioned in point 3 (a (iii))) of each contract note.

- In the field "market type" (field 70E) a category of ‘TT’ i.e. trade for trade and ‘OT’ i.e. Others shall be added to represent the supplementary categories of market types.

- The order time was prescribed as a mandatory field in the contract note. The order time shall now be included in the optional fields.

- There are certain securities which are not de-materalised and hence do not have an ISIN code. For such securities (where ISIN number is not available) the STP users would be required to input the security code given by the exchange in the ISIN number field. In case the number length of the exchange scrip code is shorter than the prescribed field length of 12 characters, the code shall be prefixed with zeros.

- In order to maintain a complete audit trail, it is clarified that in case an electronic contract note is rejected, the custodian (in messaging format IFN 548) or the fund manager (in messaging format IFN 598) shall be required to send a rejection message to the broker. Only on receipt of the rejection message, the broker shall cancel the rejected contract note and issue a fresh contract note bearing a new number.

- In order to bring in standardisation in the input of the identification codes in the prescribed messaging standards, it is clarified that the following codes shall be used by the various entities:

- Brokers: SEBI registration number (until MAPIN ID is available for every broker)

- Mutual Funds and schemes of Mutual Funds: SEBI registration number for Mutual Funds and Unique client code issued by the exchanges for schemes (until MAPIN ID is available for each scheme of a mutual fund)

- FIIs and sub-accounts: SEBI registration number for FII and Unique client code issued by the exchanges for sub-account (until MAPIN ID is available for each FII and their sub-accounts)

- Custodians: SEBI registration number (until MAPIN ID is available for every custodian)

- STP service providers and STP centralised hub: MAPIN ID

- Depositories and exchanges / clearing house / clearing corporation: MAPIN ID.

- Other Institutional Investors like financial institutions, banks etc.: Unique client code issued by the exchanges (until MAPIN ID is available for each Institutional Investor)

- All

market participants shall issue the electronic contract note for institutional trades in

the modified format enclosed in Annexure I.

4. The prescribed messaging formats for IFN 540, IFN 541, IFN 542, IFN 543, IFN 544, IFN 545, IFN 546, IFN 547, IFN 548 and IFN 598 are enclosed in Annexure II. After consultation with the market participants and confirming their preparedness, it has been decided to make these messaging formats (in addition to IFN 515) mandatory for all institutional trades w. e. f. July 1, 2004.

5. It is reiterated that the STP system shall be initially mandatory for all institutional trades in the equity segment w. e. f. July 1, 2004.

6. The standard terms of contract as are required to be mentioned in the Contract Notes as per the Bye-laws and Regulations of exchanges, which are not contained in electronic contract notes, shall be incorporated in the Client Broker Agreement or where applicable, the Tripartite Agreement between the stock broker, sub-broker and the client. The stamp duty in respect of the electronic contract notes shall be paid by the broker.

7. This circular is being issued in exercise of powers conferred by section 11 (1) of the Securities and Exchange Board of India Act, 1992, read with section 10 of the Securities Contracts(regulation) Act 1956, to protect the interests of investors in securities and to promote the development of, and to regulate the securities market.

Yours sincerely,

N.

PARAKH

Annexure I & II are available in SEBI website sebi.gov.in